Weekly Rewind: 4/18/25

Google ruled an illegal monopolist again, Arkansas breaks up big medicine, and more.

By Kainoa Lowman

Welcome back to the The Economic Populist’s Weekly Rewind. Every Friday, we’ll briefly recap the week’s biggest news, updates, and developments the in fight against corporate power.

Here’s what to know this week.

Google ruled an illegal monopolist again

On Thursday, a federal judge ruled that Google illegally monopolized key pieces of the infrastructure to buy and sell online advertising—securing the Department of Justice Antitrust Division its second landmark antitrust trial win against Google in less than a year and marking the third time Google has been found to be an illegal monopolist since December 2023.

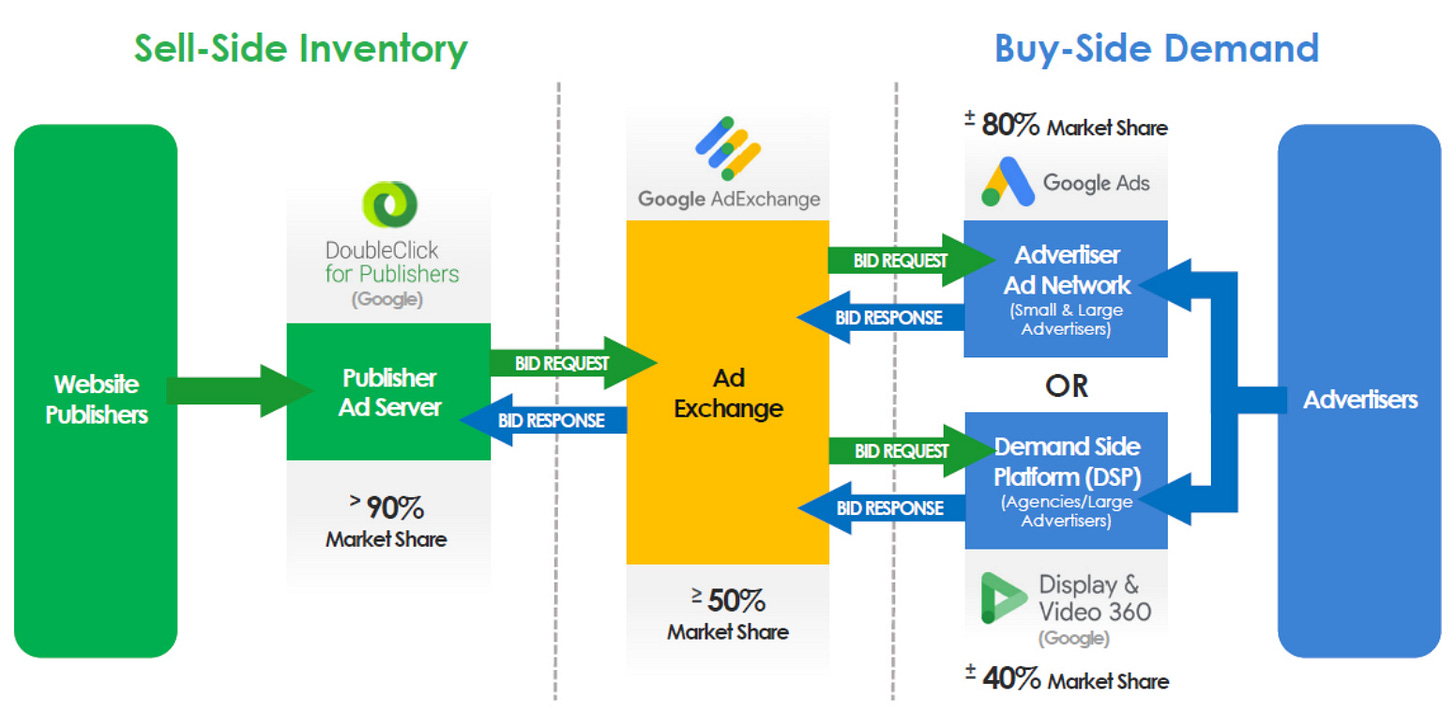

The ruling is a huge win for journalists, content creators, advertisers, “adtech” companies, and anyone who makes a living in the vast commercial realm powered by online advertising. The DOJ alleged in its case that Google, through a series of anticompetitive acquisitions, came to control all layers of the adtech “stack”--the software used by publishers to manage online ads, as well as the exchanges used to buy and sell them—effectively locking out rivals and forcing publishers and advertisers into its ecosystem. Insulated from competition in this way, Google was able to levy excessive fees on publishers and advertisers. During the trial, one would-be rival ad exchange testified that his company experimented with cutting its fee for digital ads to zero percent on ad auctions in an attempt to cut into Google’s business, yet still failed to make a dent.

Now that Google has been found liable of having an illegal monopoly, the next step will be a remedies trial, where it will be up to the Trump DOJ to decide how Google’s adtech business should be reformed or restructured to restore competition in the marketplace. Look out for updates from us.

Arkansas breaks up big medicine

On Wednesday, Arkansas Gov. Sarah Huckabee Sanders signed into law HB 1150, a structural separation law that prohibits pharmacy benefit managers (PBMs) from owning pharmacies. This makes Arkansas the first state to address this structural conflict of interest that for too long has allowed the largest PBMs to anticompetitively steer business to their own pharmacies—driving prescription drug costs up, quality down, and independent pharmacists out of business. Between January 2024 to February 2025, over 3,000 pharmacies have gone out of business across the US, many of them independently owned.

As we wrote last week when the bill passed the state legislature, HB 1150 mirrors the Patients Before Monopolies (PBM) Act (S.5503, H.R. 10362), introduced by Sens. Elizabeth Warren (D-MA) and Josh Hawley (R-MO) and Reps. Jake Auchincloss (D-MA-04) and Diana Harshbarger (R-TN-01) late last session, which would force insurers and PBMs to divest their pharmacy businesses within three years at the national level. Auchincloss discussed the PBM Act at the launch event for Economic Liberties’ Break Up Big Medicine initiative, which is building a coalition to break up vertically-integrated healthcare monopolies like UnitedHealth Group. And on Monday, a group of 39 state and territory attorneys general called on Congress to pass structural PBM reform such as the PBM act.

FTC v Meta Week 1: Zuckerberg vs Zuckerberg

The DOJ’s win against Google wasn’t the only Big Tech antitrust news this week. On Monday, trial began in the Federal Trade Commission’s lawsuit against Meta, over whether the Facebook parent illegally monopolized the market for friends-and-family social networking through anticompetitive acquisitions of Instagram and WhatsApp.

The first three days of trial featured high-stakes testimony from Meta CEO Mark Zuckerberg. An almost humorous dynamic emerged, think of it as Zuckerberg v. Zuckerberg. On the stand, Zuckerberg was repeatedly confronted with his own past statements contradicting Meta’s 2025 legal strategy. In one particularly damning email exchange from 2012, a now former Facebook exec asks Zuckerberg if he is trying to "neutralize a potential competitor" by buying Instagram or the social networking platform Path. Zuckerberg agreed: "It's a combination of (1) [neutralize a potential competitor] . . . there are network effects around social products and a finite number of different social mechanics to invest." Zuckerberg also admitted on the stand that Facebook shut down investment in the Facebook camera app after the acquisition of Instagram, a clear sign that the acquisition reduced competition and innovation.

On Tuesday, the Wall Street Journal released a bombshell report showing how Meta offered to pay $450 million in a last-ditch lobbying effort to settle the case. With testimony going the way it has so far, it’s no wonder the federal government passed on the offer and went to trial instead.

Trump CFPB helps bank lobby overturn its own rule capping late fees

In the latest update from the zombie CFPB, which the anti-leadership of the Trump Administration has effectively shut down and turned against the consumers it is meant to protect, the agency this week helped the Chamber of Commerce overturn its own rule capping the typical credit card late fee at $8.

The CFPB’s late fee rule—which caps late fees at $8 instead of $32, unless banks proved their actual collection costs exceeded that amount—was finalized under Director Rohit Chopra in March 2024. Just weeks later, the Chamber of Commerce and other banking groups sued in a corporate-friendly jurisdiction to overturn it. The judge issued an injunction last May barring the rule from taking effect.

Then, on Monday, the Trump CFPB joined the Chamber in filing a joint motion to terminate the rule altogether, with counsel for the CFPB and the Chamber writing that “the parties agree that … the Late Fee rule is contrary to law.” The Judge promptly obliged, voiding the rule on Tuesday.

For the foreseeable future, at least, this is probably the nail in the coffin for a rule that would have saved consumers an estimated $10 billion annually.

Tariff exemptions and more

Last week, President Trump added products to the list of exclusions from the still-standing 10% April 2 tariffs and 125% tariffs on Chinese goods. As Rethink Trade Director Lori Wallach lays out in this Monday thread, the products newly getting a pass include cell phones, computers, monitors, and data storage devices. The April 2 tariff announcement already excluded microchips and related goods, reportedly in anticipation of a Section 232 investigation into semiconductors, which is expected to result in new tariffs for the sector. For more details about what might be going on here, check out The Washington Post’s “How Tim Cook helped Apple out of Trump’s tariff storm — for now,” which adds the details to Trump’s Monday comment, “I speak to Tim Cook, I helped Tim Cook recently.”

See a new piece in UnHerd from Rethink Trade Research Director Daniel Rangel and AELP Director of Research Matt Stoller about the Trump administration’s incoherent trade strategy and likely consequences.

- “America is going to suffer very badly from what Trump has wrought, even if he pulls it all back now. The country will probably go into recession, and small businesses will be unable to replace Chinese supply because Team Trump just didn’t put the careful time, planning, and effort necessary to prepare for that. Meanwhile, Trump’s failure to be honest about the malign role of Wall Street and finance means America is ill-prepared for a trade-related financial crisis, should that occur.”

Read about the intersection between trade and antimonopoly policy in The Nation, written by AELP Senior Advisor Zephyr Teachout.

- “A trade policy that reflects public values would build out of the rubble of Trump. It would identify essential goods, identify workforce potential, identify opportunities and risks, and invest in diversified production. It would use tariffs and procurement and limits on capital flows to support broad-based capacity and economic independence. It would be transparent, not secretive; it would be stable, not mercurial—and it would be democratic, not captured. And yes, it would include industrial policy, currency policy, and capital controls where appropriate.”

Also catch Lori Wallach, director of the Rethink Trade program here at AELP on the Rick Smith Show, Attitude with Arnie Arnesen, and Rethinking Trade talking the latest on tariffs.

Quick Hits

Economic Liberties sent a letter urging the DOJ Antitrust Division not to let Live Nation-Ticketmaster off the hook with a light-touch remedy, and to pursue a full break-up of the notorious monopoly if their antitrust case is successful. The Hollywood Reporter has the story.

Research Director Matt Stoller and Rethink Trade Research Director Daniel Rangel have a new piece in UnHerd arguing that Trump’s chaotic tariff roll-out is discrediting populist reform and ultimately providing a saving grace to the failed neoliberal trade regime Trump is ostensibly trying to replace.

Politico has a new piece on state-level utility reform featuring our whitepaper on excessive utility investor returns.

The Trump DOJ will decide that the best remedy is to gift Google to Elon for a nominal $1 price.