Weekly Rewind: 2/21/25

DOJ launches fraud investigation into UnitedHealth Group, Trump admin commits to Khan-Kanter merger guidelines, judge halts CFPB mass-layoffs, and more.

By Kainoa Lowman

Welcome back to the The Economic Populist’s Weekly Rewind. Every Friday, we’ll briefly recap the week’s biggest news, updates, and developments the in fight against corporate power.

Here’s what to know this week:

DOJ launches fraud investigation into UnitedHealth Group

The DOJ Antitrust Division has reportedly launched an investigation into healthcare giant UnitedHealth Group’s billing practices for Medicare Advantage, the privatized version of Medicare. Specifically, enforcers are looking into fraud related to how the UnitedHealth—which is simultaneously America’s largest insurer and largest employer of doctors—records patient diagnoses.

As Economic Liberties explained in an April 2024 white paper, under Medicare Advantage’s “capitation-based” financing model, the government allocates an up-front budget to a private “risk-bearing entity,” such as an insurer like UnitedHealth, to manage patient care. This budget is “risk-adjusted” based on the documented health risk of the covered patient population (how likely they are to get sick, and need to utilize care). The insurer gets to keep as profit whatever remains of this budget after care has been paid for.

In theory, the capitation-based model should harnesses insurers' profit motive to reduce healthcare spending and waste. But since the largest insurers, such as UnitedHealth, are vertically-integrated to also controls doctors, they can game the system to pad their profits.

First, vertically-integrated insurers have an incentive to “upcode”--to pressure doctors to diagnose patients with obscure conditions, or conditions that are more serious than reality—in order to make their population look more risky and get bigger up-front budgets. It is a documented fact that UnitedHealth does this—we have a tracker.

Second, the conglomerates have an incentive to deny patients the care they need in order to keep more of that inflated up-front budget as profit. It is also a documented fact that UnitedHealth does this.

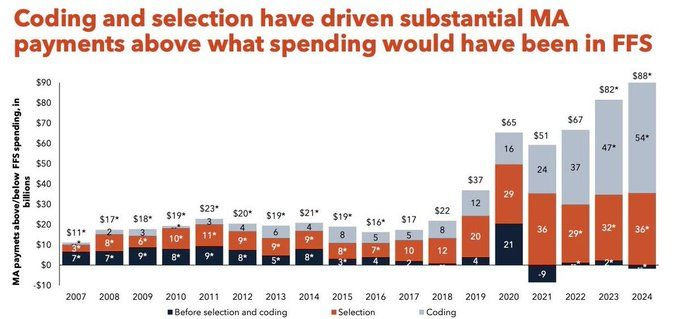

As our whitepaper explains, these perverse incentives are HUGELY wasteful—massive transfers from taxpayers to healthcare conglomerate profits. Medicare Advantage now costs taxpayers $88 billion/year more than traditional Medicare.

The new investigation, which is distinct from a long-running antitrust investigation into the company, specifically targets the “upcoding” element of UnitedHealth’s taxpayer fraud.

It’s great to some see action here, and we’ll be watching closely how this case progresses. It’s also yet another reminder of why America needs to Break Up Big Medicine—something we’re fighting for in a new initiative launched this week alongside Rep. Jake Auchincloss, FTC Chair Alvaro Bedoya, and many doctors, patient advocates, and small business owners. As Executive Director Nidhi Hegde put it at our kickoff event: “Just as the Glass-Steagall Act reined in big finance after 1929, America is in need of similar structural solutions to address the conflicts of interest that permeate the entire U.S. health care system to restore competition, reduce costs, and improve access to quality health care.”

Not what Wall Street expected: Trump admin keeps Khan-era antitrust guidelines

On Tuesday, the Trump Administration’s Federal Trade Commission and Department of Justice Antitrust Division committed to following the updated 2023 Merger Guidelines—the policy statement that lays out how antitrust enforcers interpret the law to decide which mergers to challenge—that were formulated under former FTC Chair Lina Khan and DOJ Assistant Attorney General Jonathan Kanter. The move is an important signal that a strong antitrust posture will continue under Trump, with CNBC Washington correspondent Eamon Javers saying the new administration had "put themselves on the side of the American worker." Javers continued: “That’s different than I think a lot of people on Wall Street expected.”

More broadly, the announcement goes to show that the anti-monopoly revival has bipartisan momentum, as Executive Director Nidhi Hegde told CNN.

Judge pauses CFPB mass-layoffs

Last Friday, we brought you the story of how Elon Musk’s DOGE and Project 2025 Mastermind Russ Vought teamed up to dismantle the Consumer Financial Protection Bureau—freezing work at the critical consumer watchdog agency and beginning mass firings of staff (over 100 employees were terminated last week). Remaining employees believed Vought, who is acting CFPB Director, ultimately planned to fire 95% of staff.

For now at least, that plan, like the work of the agency itself, is on ice. Following a lawsuit by the union representing CFPB employees, a federal judge ruled last Friday that the CFPB cannot fire any more workers without cause until March 3, when another hearing will take place.

We’ll certainly be keeping close tabs on this case—and others fired by the CFPB’s union and other groups. As an excellent new Associated Press story highlighted, everyday Americans will suffer in the absence of an agency many view as an apolitical “hero.”

Quick Hits

As seen in The Washington Post, we released a new joint report dealing how state lawmakers and law enforcers to crack down on discriminatory surveillance price- and wage-setting. Some states are already taking action, including California, where we’ve been proud to work with Assemblymember Chris Ward’s office towards a new bill launched this week.

The Securities and Exchange Commission has dropped its lawsuit against crypto exchange Coinbase without any financial penalty, after the company spent $75 million on political contributions during the last election, including a seven-figure contribution to Trump’s inaugural committee. The lawsuit, which alleged Coinbase was trading unregistered securities, would have been a major blow to the crypto industry’s ambition of avoiding traditional rules that protect investors.

Senior Fellow Mark Ellis wrote a fantastic op-ed in the San Francisco Chronicle leveraging his experience at the highest levels of utility finance to explain how Pacific Gas & Electric has secured exorbitant returns for shareholders at the public’s expense.

The Big Three PBMs lost their bid for a preliminary injunction against the FTC’s case over having inflated insulin costs, meaning the high-profile case can proceed.

Sr. Fellow for Healthcare Hayden Rooke-Ley has a new piece in the Journal of the American Medical Association calling on the Trump administration to move beyond the failed paradigm of value-based care.