Weekly Rewind: 1/30/26

CMS Proposes Tackling Medicare Advantage Fraud, and more.

By Kainoa Lowman and Katie Hettinga

Welcome back to the The Economic Populist’s Weekly Rewind. Every Friday, we’ll briefly recap the week’s biggest news, updates, and developments in the fight against corporate power.

Here’s what to know this week.

CMS Proposes Tackling Medicare Advantage Fraud

On Monday, the Centers for Medicare & Medicaid Services sent shockwaves through the healthcare industry when it proposed a substantially smaller-than-expected increase in the rate it will pay private insurers to administer Medicare Advantage in 2027. The news stunned Wall Street and sent big insurance stocks into free-fall, with UnitedHealth Group losing almost 20 percent of its value in a single day.

This is in stark contrast to last year, when the Trump administration awarded the MA insurers a rate increase of more than five percent. The proposed increase of just under one percent is largely due to to CMS’ lower-than-expected projection of traditional Medicare spending in 2027, which is a key benchmark for rates. But it was also driven by a completely unexpected move: CMS’ proposal to crack down on widespread fraud by insurers.

Understanding this proposal requires a bit of background on Medicare Advantage and vertical integration in healthcare. In MA, the government gives private insurers an annual, up-front budget for covering enrollees in their MA plans. This budget is “risk-adjusted,” meaning the government pays more to insurers who cover sicker populations. Whatever portion of the budget the insurer doesn’t spend on care, they get to keep as profit.

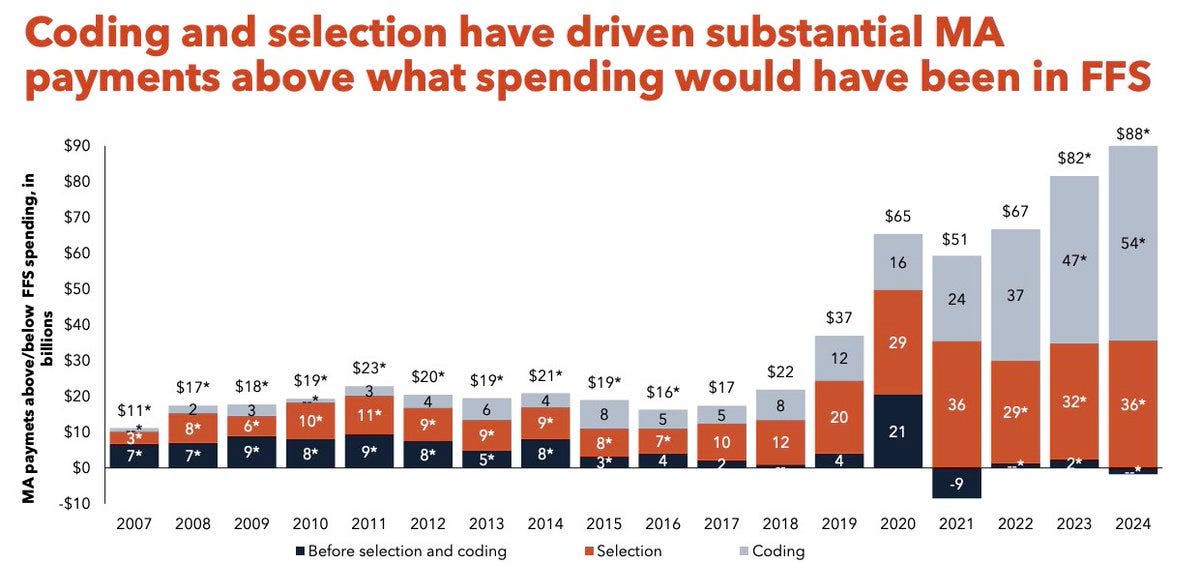

MA was sold to the American public as a cost-saving initiative. The thinking was that it would harness insurers’ profit motive to reduce spending on unnecessary care, in contrast to the “fee-for-service” payment model of traditional Medicare. Instead, as any causal observer of American corporate behavior could have guessed — and Economic Liberties showed in a 2024 whitepaper — insurers learned to game the system. By buying up physician groups, hospitals, and other provider-side entities, they could influence how their MA enrollees were diagnosed and risk-coded in the eyes of the government. The scale of this “upcoding” fraud today is massive. In 2024, the government overspent on MA by a staggering $88 billion versus traditional Medicare, mainly due to upcoding.

The new CMS proposal would eliminate one major form of upcoding fraud. CMS would no longer factor into the risk-adjustment process diagnoses that are made through “unlinked chart reviews,” where an insurer systematically reviews patient medical records to add diagnoses without the patient having actually seen a doctor. CMS projects that eliminating such diagnoses would save the government $7.12 billion in 2027. A 2024 Wall Street Journal exposé on chart reviews found that, in many cases, patients were diagnosed with conditions that doctors said were “anatomically impossible” for them to get; for instance, the WSJ found 66,000 patients were diagnosed with diabetic cataracts even though they had already undergone cataract surgery.

It’s a promising start — if, that is, the Trump administration actually administers its proposed Medicare Advantage financial medicine. Intense insurer lobbying can be expected up until the April deadline for CMS to finalize its proposal. But much more systemic reform of the American healthcare system is still needed. Economic Liberties has called for not just flattening MA overpayments but ending them altogether by ensuring parity with traditional Medicare spending, given that the two programs have very similar patient populations and coverage criteria. We also support ending private MA insurers’ abusive prior authorization requirements, which far outpace those in traditional Medicare and function to restrict older Americans’ access to medically-necessary care. And, of course, Breaking Up Big Medicine conglomerates outright would address the MA conflict of interest alongside a whole host of issues across healthcare.

But, again, CMS’ proposed financial surgery is yet another financial headwind against vertically-integrated insurers like UnitedHealth Group, which have come under intense government scrutiny for a range of fraudulent and abusive business practices. We’ll be watching closely and keeping you updated.

Is Trump’s Tariff Policy Bark Bigger than Its Bite?

This week, Trump proclaimed via Truth Social that he was increasing tariffs on South Korea to 25%. That’s quite an increase from the 15% rate the White House negotiated withSouth Korea in a “trade agreement” announced by Trump just last fall. Trump blamed the tariff increase on the South Korean National Assembly’s failure to enact the promised agreement. But speculation abounds that the threats actually are related to South Korean regulation of large digital companies. South Korea has accused several home-grown firms of monopolistic abuses and breaches of consumers’ data security and is cracking down on the behavior. South Korea’s app store competition law is the model for the leading U.S. bipartisan bill tackling the Apple-Google app store duopoly, and a pending anti-monopoly law is under attack by U.S. Big Tech because it could also set a global standard.

So what’s up with the Trump administration? One theory involves Coupang, a company that controls controls a large share of South Korea’s e-commerce. Several U.S. venture capital and other large U.S. investors back the firm, although it only operates in South Korea. Those investors are now trying to label Coupang as a U.S. firm and engage the Trump administration in threatening the South Korean government over a recent investigation into a massive Coupang data leak, which South Korean news reports describe as affecting 90% of the nation’s adults. The investors’ ploy seems to be working: Vice President JD Vance last week warned South Korea’s Prime Minister not to penalize U.S. tech firms — including Coupang.

Another possibility: Trump may be concerned about the EU following through on its tariff agreement negotiated in July of 2025, and is threatening South Korea as a warning. Previously agreed-upon tariff cuts had not been enacted by the EU when Trump threatened then walked back new tariffs on seven European countries and the UK that sent military resources to Greenland to dissuade Trump from escalating his takeover threats. After suspending its plans to implement the deal, the European Parliament now is in talks to add a clause to the trade framework that would void the deal if Trump threatens Greenland again.

The several other countries with which Trump’s White House has negotiated deals (or “frameworks”) are certainly watching to see how these tariff threat sagas turn out. In the meantime, the Chinese government is busy courting some Western countries unnerved by Trump’s trade chaos.

Quick Hits

Economic Liberties Senior Legal Counsel Lee Hepner joined Hard Reset Media at the Sundance film festival for a panel on the harms of a Warner Bros. acquisition by Netflix or Paramount. Economic Liberties joined filmmakers and independent movie theaters in sending a letter calling on state attorneys general to block the sale of Warner Bros. Lee also did a sit-down interview on the subject with Al Jazeera.

The Wall Street Journal reports that the pharma companies cut the prices of 20 major brand-name drugs in January, after the direct Medicare price negotiation enabled by the 2022 Inflation Reduction Act went into effect for the first time this year.

A few notable corporate Trump bribes this week. On Wednesday, Visa announced it will allow credit card holders to stash their rewards points in “Trump Accounts,” the new government-seeded child savings accounts formally unveiled by the President this week. (Visa faces a longstanding DOJ antitrust suit for monopolistic behavior in the payment network market.) And then there is the documentary Melania, which opened this week. Amazon paid a production company connected to the First Lady $40 million for licensing rights, and is pouring tens of millions more into promoting the movie.

Sen. Elizabeth Warren sent a letter to OpenAI fishing for a commitment that the company won’t seek a government bailout if its reckless spending causes it to fail amidst an AI bubble crash.

The Netherlands is moving to ban incentive-based pay for veterinarians, a misaligned incentive that is also thought to be a key driver behind rising vet care costs in America.

We, the people, are being asked to spend billions more on ICE. We should be spending on accountants and IT professionals to weed out fraud to actually save $$. Too logical….

Just don't whitewash the Racketeer Dr. Oz.